Streamlining Revenue: How CRM with Automated Billing Reminders Revolutionizes Business

In today’s fast-paced business landscape, managing customer relationships effectively is paramount. Customer Relationship Management (CRM) systems have become indispensable tools for organizations seeking to enhance customer engagement, improve sales processes, and foster long-term loyalty. However, the power of a CRM extends far beyond basic contact management. When integrated with automated billing reminders, a CRM system can transform into a revenue-generating engine, streamlining financial operations, reducing late payments, and enhancing the overall customer experience.

The Power of CRM: A Foundation for Customer-Centric Growth

At its core, a CRM system serves as a centralized hub for all customer-related information. It consolidates data from various touchpoints, including sales interactions, marketing campaigns, customer service inquiries, and billing transactions. This comprehensive view enables businesses to understand customer preferences, anticipate their needs, and deliver personalized experiences.

Key benefits of a CRM system include:

- Improved Customer Understanding: Gain insights into customer behavior, purchase history, and communication patterns.

- Enhanced Sales Productivity: Automate sales processes, track leads, and manage opportunities more efficiently.

- Better Marketing Campaigns: Segment customer lists, personalize marketing messages, and track campaign performance.

- Superior Customer Service: Resolve issues faster, provide proactive support, and build stronger customer relationships.

- Data-Driven Decision Making: Leverage data analytics to identify trends, optimize strategies, and make informed decisions.

The Challenge of Billing and Accounts Receivable

While CRM systems excel at managing customer interactions, the billing and accounts receivable process often remains a separate, manual operation. This disconnect can lead to inefficiencies, errors, and delays in payment collection. Common challenges include:

- Manual Invoice Creation: Generating invoices manually is time-consuming and prone to errors.

- Late Payment Tracking: Monitoring payment due dates and following up on overdue invoices requires significant effort.

- Inconsistent Communication: Sending payment reminders manually can be inconsistent and impersonal.

- Customer Dissatisfaction: Delayed or inaccurate billing can damage customer relationships.

- Cash Flow Problems: Late payments can disrupt cash flow and impact business operations.

Automated Billing Reminders: A Game-Changer for Revenue Management

Automated billing reminders bridge the gap between CRM and accounts receivable, transforming the billing process into a seamless, efficient, and customer-friendly operation. By integrating automated billing reminders into a CRM system, businesses can:

- Streamline the Billing Process: Automatically generate and send invoices based on predefined schedules and triggers.

- Reduce Late Payments: Send timely reminders to customers before, on, and after the payment due date.

- Improve Cash Flow: Accelerate payment collection and reduce the need for manual follow-up.

- Enhance Customer Satisfaction: Provide clear, consistent, and personalized billing communication.

- Reduce Administrative Costs: Automate tasks, freeing up staff to focus on more strategic initiatives.

Benefits of CRM with Automated Billing Reminders

Integrating automated billing reminders into a CRM system offers a multitude of benefits that extend beyond simple payment collection:

-

Improved Cash Flow: By sending timely reminders and facilitating easy payment options, businesses can significantly reduce late payments and improve cash flow. This financial stability allows for better planning, investment, and growth.

-

Reduced Administrative Overhead: Automating the billing process eliminates the need for manual invoice creation, tracking, and follow-up. This frees up valuable time for accounting staff to focus on more strategic tasks, such as financial analysis and reporting.

-

Enhanced Customer Experience: Personalized and timely billing reminders demonstrate a commitment to customer service. By providing clear payment instructions, multiple payment options, and prompt responses to inquiries, businesses can foster stronger customer relationships.

-

Increased Revenue: By reducing late payments and improving cash flow, automated billing reminders can directly impact revenue. Additionally, the improved customer experience can lead to increased customer retention and repeat business.

-

Better Data Insights: Integrating billing data into the CRM system provides a more comprehensive view of customer behavior and financial performance. This data can be used to identify trends, optimize pricing strategies, and improve overall business decision-making.

-

Improved Compliance: Automated billing reminders can help businesses comply with industry regulations and accounting standards. By maintaining accurate records and sending timely payment notifications, businesses can reduce the risk of penalties and legal issues.

Implementing CRM with Automated Billing Reminders: A Step-by-Step Guide

Implementing a CRM system with automated billing reminders requires careful planning and execution. Here’s a step-by-step guide to ensure a successful implementation:

-

Assess Your Needs: Identify your specific billing challenges and requirements. Determine the features and functionalities you need in a CRM system and automated billing solution.

-

Choose the Right Software: Research and compare different CRM systems and billing automation tools. Consider factors such as pricing, features, integration capabilities, and customer support.

-

Integrate Your Systems: Ensure that your CRM system and billing automation tool are seamlessly integrated. This will allow for the automatic transfer of data between the two systems, streamlining the billing process.

-

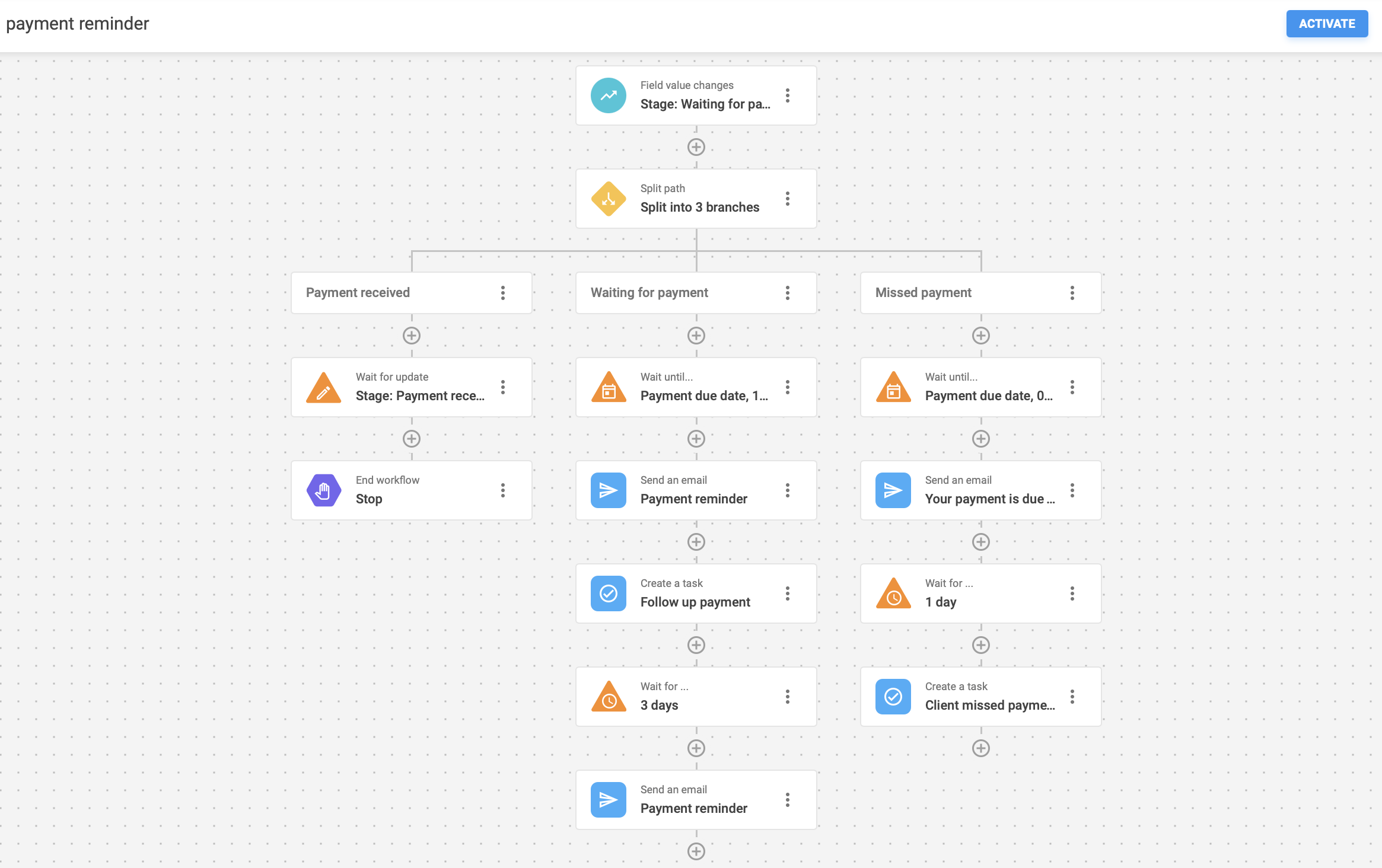

Customize Your Settings: Configure the automated billing reminders to align with your business policies and customer preferences. Set up payment schedules, reminder frequencies, and communication channels.

-

Train Your Staff: Provide comprehensive training to your staff on how to use the new system. Ensure that they understand the billing process, how to respond to customer inquiries, and how to troubleshoot any issues.

-

Test and Monitor: Thoroughly test the system to ensure that it is working properly. Monitor the billing process closely and make adjustments as needed.

-

Communicate with Customers: Inform your customers about the new billing system and the benefits it offers. Provide clear instructions on how to make payments and contact support.

Best Practices for Automated Billing Reminders

To maximize the effectiveness of automated billing reminders, consider the following best practices:

- Personalize Your Reminders: Use customer names and other relevant information to personalize your reminders.

- Offer Multiple Payment Options: Provide customers with a variety of payment options, such as credit cards, debit cards, bank transfers, and online payment platforms.

- Send Reminders in Advance: Send reminders several days before the payment due date to give customers ample time to pay.

- Use Multiple Communication Channels: Send reminders via email, SMS, and even phone calls to ensure that customers receive the message.

- Track Results and Optimize: Monitor the effectiveness of your billing reminders and make adjustments as needed.

Conclusion

Integrating automated billing reminders into a CRM system is a strategic investment that can transform the way businesses manage revenue. By streamlining the billing process, reducing late payments, and enhancing customer satisfaction, this powerful combination can improve cash flow, reduce administrative costs, and drive sustainable growth. As businesses strive to compete in today’s dynamic marketplace, embracing CRM with automated billing reminders is no longer a luxury but a necessity for success.