CRM with Funding Round Tracker: A Winning Combination for Startups and Investors

In the dynamic world of startups and venture capital, staying organized and informed is paramount. Customer Relationship Management (CRM) systems have long been essential tools for managing customer interactions, sales pipelines, and marketing efforts. However, for startups constantly seeking funding and investors managing multiple deals, a traditional CRM often falls short.

This is where the integration of a CRM with a dedicated funding round tracker becomes a game-changer. This powerful combination streamlines processes, enhances communication, and provides invaluable insights, ultimately increasing the chances of securing funding and making smarter investment decisions.

The Limitations of Traditional CRMs for Funding

While CRMs are excellent for managing customer data, they often lack the specific features needed to effectively track funding rounds:

- Deal-Specific Information: Traditional CRMs struggle to capture the nuances of funding rounds, such as term sheets, valuation metrics, investor preferences, and due diligence progress.

- Investor Management: While CRMs can store contact information, they don’t always provide a clear view of investor portfolios, investment history, and preferred industries.

- Pipeline Visibility: It’s challenging to visualize the entire funding pipeline within a standard CRM, making it difficult to identify bottlenecks and prioritize outreach efforts.

- Reporting and Analytics: Generic CRM reports often don’t provide the specific insights needed to analyze funding progress, investor engagement, and the overall effectiveness of fundraising efforts.

The Power of Integration: CRM + Funding Round Tracker

Integrating a CRM with a funding round tracker addresses these limitations by providing a centralized platform for managing both customer relationships and fundraising activities. Here’s how this integration benefits both startups and investors:

For Startups:

-

Streamlined Fundraising Process:

- Centralized Data: All funding-related information, including investor profiles, term sheets, pitch decks, and communication logs, are stored in one place.

- Automated Workflows: Automate tasks such as sending follow-up emails, scheduling meetings, and updating deal statuses.

- Improved Collaboration: Enable seamless collaboration between team members involved in the fundraising process, ensuring everyone is on the same page.

-

Enhanced Investor Management:

- Targeted Outreach: Identify investors whose investment criteria align with your startup’s industry, stage, and funding needs.

- Personalized Communication: Tailor your pitch and communication based on investor preferences and past investment behavior.

- Stronger Relationships: Build and maintain strong relationships with potential investors by tracking interactions and providing timely updates.

-

Improved Pipeline Visibility:

- Real-Time Tracking: Monitor the progress of each funding round, from initial contact to closing.

- Bottleneck Identification: Identify potential roadblocks and proactively address them to keep the fundraising process on track.

- Prioritization: Focus on the most promising leads and allocate resources effectively.

-

Data-Driven Decision Making:

- Performance Analysis: Track key metrics such as investor response rates, deal closure rates, and time-to-funding.

- Insights and Reporting: Generate reports to identify trends, patterns, and areas for improvement in your fundraising strategy.

- Strategic Planning: Make informed decisions about fundraising targets, investor outreach, and deal terms.

-

Increased Efficiency and Productivity:

- Reduced Manual Work: Automate repetitive tasks and eliminate the need for manual data entry.

- Time Savings: Free up valuable time to focus on core business activities and strategic initiatives.

- Improved Organization: Maintain a clear and organized view of your fundraising efforts, reducing stress and improving overall efficiency.

For Investors:

-

Efficient Deal Flow Management:

- Centralized Deal Tracking: Manage all potential investments in one place, from initial screening to due diligence and closing.

- Automated Workflows: Streamline the due diligence process by automating tasks such as document requests and background checks.

- Improved Collaboration: Enable seamless collaboration between investment team members, ensuring everyone is aligned on deal terms and potential risks.

-

Enhanced Startup Evaluation:

- Comprehensive Data: Access a wealth of information about each startup, including financial metrics, market analysis, and team profiles.

- Due Diligence Tracking: Monitor the progress of due diligence activities, such as financial audits, legal reviews, and market research.

- Risk Assessment: Identify potential risks and opportunities associated with each investment.

-

Improved Portfolio Management:

- Performance Tracking: Monitor the performance of existing portfolio companies, including revenue growth, customer acquisition, and market share.

- Early Warning Signals: Identify potential problems or challenges faced by portfolio companies.

- Strategic Support: Provide targeted support and guidance to portfolio companies to help them achieve their goals.

-

Data-Driven Investment Decisions:

- Performance Analysis: Track key metrics such as IRR, ROI, and exit multiples.

- Market Insights: Analyze market trends and identify promising investment opportunities.

- Portfolio Optimization: Make informed decisions about portfolio allocation and diversification.

-

Enhanced Communication:

- Centralized Communication Log: Store all communication with potential and existing portfolio companies in one place.

- Automated Updates: Send regular updates to investors about the performance of portfolio companies.

- Improved Transparency: Maintain open and transparent communication with investors.

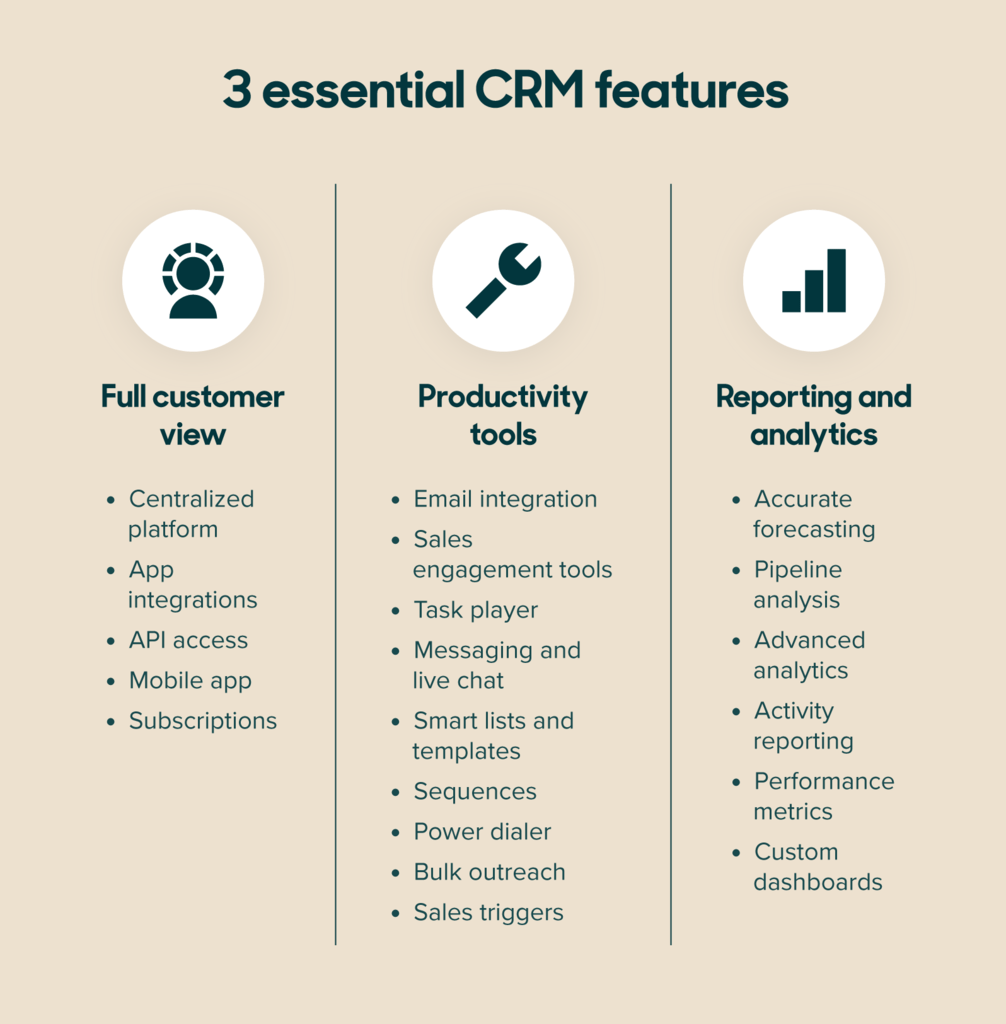

Key Features to Look For:

When selecting a CRM with a funding round tracker, consider the following features:

- Customizable Fields: The ability to create custom fields to capture specific information about funding rounds, investors, and startups.

- Workflow Automation: Tools to automate repetitive tasks and streamline the fundraising or investment process.

- Reporting and Analytics: Robust reporting capabilities to track key metrics and gain insights into fundraising or investment performance.

- Integration with Other Tools: Seamless integration with other tools such as email marketing platforms, document management systems, and accounting software.

- Mobile Accessibility: The ability to access the CRM and funding round tracker from anywhere, at any time.

- Security: Robust security measures to protect sensitive data.

Choosing the Right Solution

Several CRM solutions offer integrated funding round tracking capabilities or can be customized to meet the specific needs of startups and investors. Some popular options include:

- Affinity: A relationship intelligence platform designed for dealmakers, including venture capital firms and investment banks.

- HubSpot: A popular CRM platform with marketing automation and sales tools that can be customized for fundraising.

- Salesforce: A highly customizable CRM platform that can be adapted to track funding rounds and manage investor relationships.

- Pipedrive: A sales-focused CRM that offers features for tracking deals and managing contacts.

Conclusion

Integrating a CRM with a funding round tracker is a strategic move for both startups and investors. By streamlining processes, enhancing communication, and providing valuable insights, this powerful combination increases the chances of securing funding, making smarter investment decisions, and ultimately achieving success in the competitive world of startups and venture capital. By carefully evaluating your needs and selecting the right solution, you can unlock the full potential of this integration and gain a significant competitive advantage.