CRM for Investor Relations: Building Stronger, More Profitable Connections

In the fast-paced world of finance, maintaining strong relationships with investors is paramount. Investor relations (IR) professionals are tasked with communicating a company’s financial performance, strategy, and outlook to shareholders, analysts, and potential investors. Effective communication and relationship management are key to fostering trust, attracting capital, and ultimately, driving long-term value. This is where Customer Relationship Management (CRM) systems come into play, specifically tailored for investor relations.

The Evolution of Investor Relations

Traditionally, investor relations relied on manual processes, spreadsheets, and fragmented communication channels. Tracking investor interactions, managing contact information, and analyzing sentiment were time-consuming and prone to errors. However, as the financial landscape became more complex and competitive, IR professionals recognized the need for a more sophisticated approach.

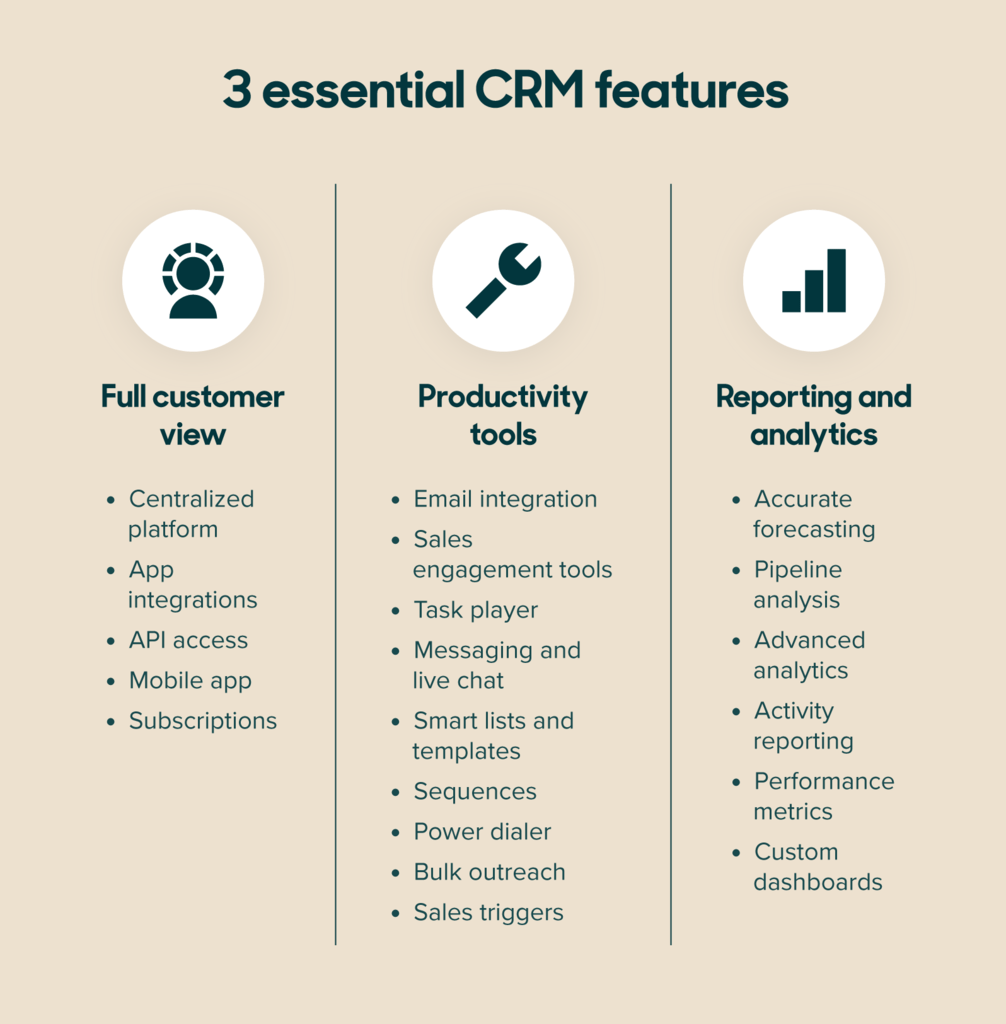

CRM systems emerged as a solution to streamline investor relations, providing a centralized platform to manage interactions, track engagement, and gain valuable insights. Investor CRM tools are specifically designed to address the unique needs of IR professionals, offering features such as:

-

Contact Management: A centralized database to store investor information, including contact details, investment preferences, communication history, and relationship scores.

-

Communication Tracking: The ability to record all interactions with investors, including emails, phone calls, meetings, and events.

-

Event Management: Tools to plan, promote, and manage investor events, such as earnings calls, investor days, and roadshows.

-

Reporting and Analytics: Customizable dashboards and reports to track key metrics, such as investor engagement, sentiment, and ownership analysis.

-

Compliance Management: Features to ensure compliance with regulatory requirements, such as SEC regulations and insider trading policies.

Why CRM is Essential for Modern Investor Relations

In today’s digital age, investors have access to vast amounts of information and a multitude of investment opportunities. To stand out from the crowd, companies must engage with investors in a personalized and proactive manner. Investor CRM tools enable IR professionals to:

-

Enhance Investor Engagement: By providing a comprehensive view of each investor, IR professionals can tailor their communication to individual preferences and interests. This leads to more meaningful interactions and stronger relationships.

-

Improve Communication Effectiveness: CRM systems enable IR professionals to track the effectiveness of their communication efforts, identifying which messages resonate with investors and which ones need improvement.

-

Streamline Workflow and Efficiency: Automating tasks such as contact management, communication tracking, and reporting frees up time for IR professionals to focus on strategic initiatives.

-

Gain Deeper Insights: CRM systems provide valuable insights into investor behavior, sentiment, and ownership patterns. This information can be used to identify potential risks and opportunities, and to develop more effective IR strategies.

-

Strengthen Compliance: By centralizing investor information and tracking communication, CRM systems help companies ensure compliance with regulatory requirements.

Key Features of Investor CRM Tools

When choosing a CRM system for investor relations, it’s important to consider the following features:

-

Contact Management: The system should provide a centralized database to store investor information, including contact details, investment preferences, communication history, and relationship scores. It should also allow for easy segmentation of investors based on criteria such as investment size, industry, and geographic location.

-

Communication Tracking: The system should track all interactions with investors, including emails, phone calls, meetings, and events. This includes the ability to log notes, documents, and other relevant information.

-

Event Management: The system should provide tools to plan, promote, and manage investor events, such as earnings calls, investor days, and roadshows. This includes features for registration, attendance tracking, and post-event follow-up.

-

Reporting and Analytics: The system should offer customizable dashboards and reports to track key metrics, such as investor engagement, sentiment, and ownership analysis. This includes the ability to generate reports on investor demographics, communication effectiveness, and compliance.

-

Compliance Management: The system should include features to ensure compliance with regulatory requirements, such as SEC regulations and insider trading policies. This includes the ability to track insider trading activity, monitor communication for compliance risks, and generate audit trails.

-

Integration with Other Systems: The CRM system should integrate seamlessly with other systems used by the IR team, such as financial data providers, news feeds, and social media platforms. This allows for a more holistic view of investor sentiment and market trends.

-

Mobile Access: The system should be accessible on mobile devices, allowing IR professionals to stay connected with investors while on the go.

Benefits of Using CRM in Investor Relations

-

Improved Investor Relations: By providing a comprehensive view of each investor, IR professionals can tailor their communication to individual preferences and interests. This leads to more meaningful interactions and stronger relationships.

-

Increased Efficiency: Automating tasks such as contact management, communication tracking, and reporting frees up time for IR professionals to focus on strategic initiatives.

-

Better Decision-Making: CRM systems provide valuable insights into investor behavior, sentiment, and ownership patterns. This information can be used to identify potential risks and opportunities, and to develop more effective IR strategies.

-

Enhanced Compliance: By centralizing investor information and tracking communication, CRM systems help companies ensure compliance with regulatory requirements.

-

Greater Transparency: CRM systems provide a clear audit trail of all investor interactions, making it easier to demonstrate transparency and accountability.

Choosing the Right Investor CRM

Selecting the appropriate CRM system for investor relations is crucial. Here are factors to consider:

- Specific IR Needs: The CRM should be tailored to the unique demands of investor relations, not just a generic sales CRM.

- Scalability: The system should be able to grow with the company’s needs.

- Ease of Use: The system should be user-friendly and easy to learn.

- Integration Capabilities: The system should integrate with other essential tools.

- Vendor Reputation: Choose a vendor with a strong track record and experience in the financial industry.

Implementation and Best Practices

- Data Migration: Transferring existing investor data into the CRM system.

- Training: Providing training to IR professionals on how to use the system effectively.

- Customization: Customizing the system to meet the specific needs of the IR team.

- Ongoing Maintenance: Regularly updating and maintaining the system to ensure optimal performance.

The Future of CRM in Investor Relations

The future of CRM in investor relations is bright. As technology continues to evolve, CRM systems will become even more sophisticated, offering features such as:

-

Artificial Intelligence (AI): AI-powered CRM systems will be able to analyze investor sentiment, predict future behavior, and automate tasks such as communication and reporting.

-

Blockchain Technology: Blockchain technology can be used to create a secure and transparent record of investor ownership and transactions.

-

Virtual Reality (VR): VR technology can be used to create immersive investor experiences, such as virtual tours of company facilities.

Conclusion

In today’s competitive financial landscape, investor relations professionals must leverage the power of technology to build stronger, more profitable connections with investors. Investor CRM tools provide a centralized platform to manage interactions, track engagement, and gain valuable insights. By implementing a CRM system tailored for investor relations, companies can enhance investor engagement, improve communication effectiveness, streamline workflow and efficiency, gain deeper insights, and strengthen compliance. As technology continues to evolve, CRM systems will become even more essential for investor relations, offering features such as AI, blockchain technology, and virtual reality.