CRM for Insurance Agents and Brokers: Streamlining Operations and Boosting Sales

In today’s competitive insurance landscape, agents and brokers face the constant challenge of managing leads, nurturing client relationships, and closing deals. To succeed, they need to leverage technology that can streamline operations, enhance client engagement, and ultimately drive sales growth. Customer Relationship Management (CRM) software has emerged as an indispensable tool for insurance professionals, offering a centralized platform to manage all aspects of their business.

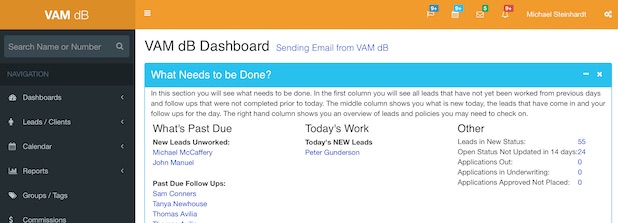

What is CRM and How Does it Work for Insurance?

CRM software is a technology designed to manage and analyze customer interactions and data throughout the customer lifecycle, with the goal of improving business relationships, assisting in customer retention, and driving sales growth. For insurance agents and brokers, CRM serves as a hub for managing leads, client information, policy details, communications, and sales activities.

Here’s how CRM works for insurance:

- Lead Management: CRM systems allow agents to capture leads from various sources, such as website forms, referrals, and marketing campaigns. They can then track and prioritize these leads based on their potential value.

- Contact Management: CRM provides a centralized database for storing and organizing client information, including contact details, policy information, communication history, and personal preferences.

- Policy Management: Agents can use CRM to track policy details, such as coverage amounts, premiums, renewal dates, and claim history. This ensures they have a comprehensive view of each client’s insurance portfolio.

- Communication Tracking: CRM systems log all interactions with clients, including emails, phone calls, meetings, and social media messages. This helps agents maintain a consistent and personalized communication strategy.

- Sales Automation: CRM automates repetitive tasks, such as sending follow-up emails, scheduling appointments, and generating reports. This frees up agents’ time to focus on building relationships and closing deals.

Benefits of CRM for Insurance Agents and Brokers

Implementing a CRM system can bring numerous benefits to insurance agents and brokers, including:

- Improved Lead Management: CRM helps agents capture, track, and prioritize leads effectively. By identifying the most promising leads and nurturing them with targeted communication, agents can increase their conversion rates and close more deals.

- Enhanced Client Relationships: CRM enables agents to personalize their interactions with clients by providing a complete view of their needs and preferences. This leads to stronger relationships, increased client loyalty, and more referrals.

- Streamlined Operations: CRM automates many administrative tasks, such as data entry, appointment scheduling, and report generation. This frees up agents’ time to focus on more strategic activities, such as client engagement and sales.

- Increased Sales Productivity: By providing agents with the tools and information they need to succeed, CRM can significantly increase their sales productivity. Agents can close more deals in less time, leading to higher revenue.

- Better Data Analysis: CRM systems collect and analyze data on client interactions, sales activities, and marketing campaigns. This data can be used to identify trends, optimize strategies, and make better business decisions.

- Improved Compliance: CRM can help insurance agents comply with industry regulations by tracking client interactions, documenting policy details, and generating audit trails.

- Centralized Information: All client and policy information is stored in one place, accessible to authorized personnel. This eliminates the need for disparate spreadsheets and databases, ensuring data consistency and accuracy.

- Mobile Accessibility: Many CRM systems offer mobile apps, allowing agents to access client information, manage leads, and communicate with clients from anywhere. This is particularly useful for agents who spend a lot of time in the field.

Key Features of a CRM for Insurance

When choosing a CRM for insurance, agents and brokers should look for the following key features:

- Contact Management: A robust contact management system that allows agents to store and organize client information, including contact details, policy information, communication history, and personal preferences.

- Lead Management: A lead management module that enables agents to capture leads from various sources, track their progress, and prioritize them based on their potential value.

- Policy Management: A policy management feature that allows agents to track policy details, such as coverage amounts, premiums, renewal dates, and claim history.

- Communication Tracking: A communication tracking system that logs all interactions with clients, including emails, phone calls, meetings, and social media messages.

- Sales Automation: Sales automation tools that automate repetitive tasks, such as sending follow-up emails, scheduling appointments, and generating reports.

- Reporting and Analytics: Reporting and analytics capabilities that allow agents to track key metrics, identify trends, and make data-driven decisions.

- Integration with Other Systems: Integration with other systems, such as email marketing platforms, accounting software, and insurance carrier portals.

- Mobile Accessibility: A mobile app that allows agents to access client information, manage leads, and communicate with clients from anywhere.

- Compliance Features: Features that help agents comply with industry regulations, such as data encryption, audit trails, and consent management.

Choosing the Right CRM for Your Insurance Business

Selecting the right CRM for your insurance business requires careful consideration of your specific needs and budget. Here are some factors to consider:

- Business Size and Complexity: Choose a CRM that is appropriate for the size and complexity of your business. Small agencies may be able to get by with a simpler CRM, while larger agencies may need a more robust system.

- Specific Needs: Identify your specific needs and choose a CRM that offers the features and functionality you require. For example, if you focus on selling a particular type of insurance, such as life insurance, you may want to choose a CRM that is specifically designed for that niche.

- Budget: CRM systems vary in price, so it’s important to set a budget before you start shopping. Consider the total cost of ownership, including subscription fees, implementation costs, and training expenses.

- Ease of Use: Choose a CRM that is easy to use and intuitive. A complex CRM that is difficult to learn will not be adopted by your team, and you will not see the benefits of the system.

- Customer Support: Make sure the CRM vendor offers excellent customer support. You will want to be able to get help when you need it.

- Scalability: Choose a CRM that can scale with your business. As your business grows, you will want a CRM that can handle the increased volume of data and transactions.

Popular CRM Systems for Insurance Agents and Brokers

Several CRM systems are specifically designed for insurance agents and brokers. Some of the most popular options include:

- Salesforce: A leading CRM platform that offers a wide range of features and integrations.

- Zoho CRM: A popular CRM system that is affordable and easy to use.

- HubSpot CRM: A free CRM system that is ideal for small businesses.

- AgencyBloc: A CRM designed specifically for insurance agencies.

- Vertafore AMS360: An agency management system that includes CRM functionality.

- Applied Epic: A cloud-based agency management system with CRM capabilities.

Tips for Implementing CRM Successfully

Implementing a CRM system is a significant undertaking, but it can be successful if you follow these tips:

- Define Your Goals: Clearly define your goals for implementing CRM. What do you want to achieve?

- Involve Your Team: Involve your team in the selection and implementation process. Get their feedback and address their concerns.

- Provide Training: Provide adequate training to your team on how to use the CRM system.

- Start Small: Start with a small implementation and gradually roll out more features.

- Monitor and Evaluate: Monitor and evaluate the performance of the CRM system. Make adjustments as needed.

- Customize the System: Customize the CRM system to meet your specific needs.

Conclusion

CRM software is an essential tool for insurance agents and brokers who want to streamline operations, enhance client engagement, and drive sales growth. By choosing the right CRM and implementing it effectively, insurance professionals can gain a competitive edge and achieve greater success in today’s dynamic insurance market. As the insurance industry continues to evolve, CRM will undoubtedly play an increasingly important role in helping agents and brokers thrive.