CRM for Angel Investors: Cultivating Relationships and Maximizing Returns

In the dynamic world of angel investing, success hinges not only on identifying promising startups but also on building and nurturing strong relationships. Angel investors, who provide early-stage capital to nascent companies, often wear multiple hats – mentor, advisor, and advocate. To manage these multifaceted roles effectively, a robust Customer Relationship Management (CRM) system is no longer a luxury but a necessity.

This article delves into the crucial role of CRM for angel investors, exploring its benefits, key features, implementation strategies, and how it can ultimately lead to enhanced deal flow, improved portfolio management, and maximized returns.

The Unique Challenges of Angel Investing

Angel investing differs significantly from other investment classes. It’s characterized by:

- High Volume of Interactions: Angels constantly interact with founders, other investors, industry experts, and potential advisors. Managing these interactions efficiently is paramount.

- Relationship-Driven Decisions: Investment decisions are often based on trust and rapport with the founders. Tracking the evolution of these relationships is vital.

- Long Investment Horizon: Angel investments typically require patience, with returns often realized after several years. Maintaining consistent engagement with portfolio companies is crucial during this period.

- Illiquidity: Angel investments are notoriously illiquid. Investors need to proactively manage their portfolio and track progress to make informed decisions about follow-on investments or potential exits.

- Limited Resources: Many angel investors operate with limited administrative support. A CRM system can automate tasks and streamline processes, freeing up valuable time.

Why CRM is Essential for Angel Investors

A well-implemented CRM system addresses these challenges by providing a centralized platform to manage contacts, track interactions, and analyze data. Here’s how it benefits angel investors:

-

Centralized Contact Management:

- Comprehensive Profiles: A CRM allows investors to create detailed profiles for each contact, including founders, co-investors, advisors, and potential partners. This goes beyond basic contact information to include notes on past conversations, investment preferences, areas of expertise, and even personal interests.

- Relationship Mapping: Visualizing relationships between contacts is crucial. A CRM can map out networks, revealing potential synergies and opportunities for collaboration.

- Segmentation and Tagging: Categorizing contacts based on industry, investment stage, or other relevant criteria enables targeted communication and personalized engagement.

-

Streamlined Deal Flow Management:

- Tracking Opportunities: From initial pitch to final investment, a CRM helps manage the entire deal flow process. Investors can track the progress of each opportunity, document due diligence findings, and manage investment terms.

- Automated Workflows: Automating tasks such as sending follow-up emails, scheduling meetings, and generating reports can significantly improve efficiency.

- Collaboration: Sharing deal information and collaborating with co-investors becomes seamless with a centralized CRM system.

-

Enhanced Portfolio Management:

- Performance Tracking: A CRM enables investors to track the performance of their portfolio companies, monitor key metrics, and identify potential red flags early on.

- Communication Log: Maintaining a detailed log of all communication with portfolio companies, including meetings, emails, and phone calls, ensures transparency and accountability.

- Reporting and Analysis: Generating reports on portfolio performance, investment returns, and other key metrics provides valuable insights for decision-making.

-

Improved Communication and Collaboration:

- Personalized Communication: A CRM allows investors to personalize their communication with founders and co-investors, building stronger relationships and fostering trust.

- Centralized Communication History: Having a complete history of all communication with each contact in one place ensures that everyone is on the same page.

- Facilitating Introductions: A CRM can help investors identify relevant contacts and make introductions, expanding their network and creating new opportunities for their portfolio companies.

-

Data-Driven Decision Making:

- Identifying Trends: Analyzing data within the CRM can reveal trends in the market, identify promising sectors, and improve investment strategies.

- Evaluating Performance: Tracking key metrics and analyzing performance data allows investors to make informed decisions about future investments.

- Risk Mitigation: Identifying potential risks early on and taking proactive measures can help mitigate losses.

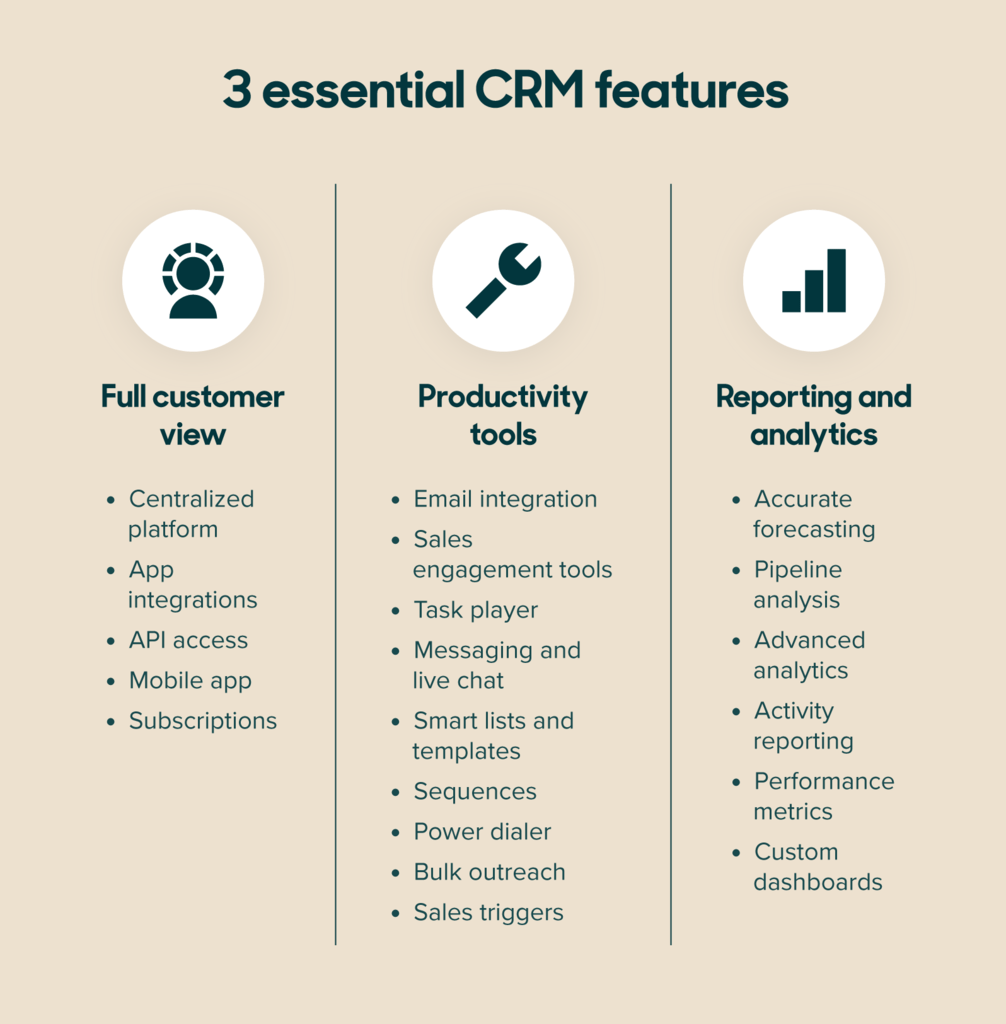

Key Features to Look for in a CRM for Angel Investors

When selecting a CRM system, angel investors should look for features that specifically address their unique needs:

- Contact Management: Robust contact management capabilities, including detailed profiles, relationship mapping, and segmentation.

- Deal Flow Management: Tools for tracking opportunities, managing due diligence, and collaborating with co-investors.

- Portfolio Management: Features for tracking portfolio performance, monitoring key metrics, and managing communication with portfolio companies.

- Reporting and Analytics: Comprehensive reporting and analytics capabilities to track performance, identify trends, and make informed decisions.

- Integration: Integration with other tools, such as email, calendar, and accounting software.

- Mobile Accessibility: Mobile app for accessing information and managing tasks on the go.

- Customization: The ability to customize the CRM to meet specific needs and workflows.

- Security: Robust security measures to protect sensitive data.

- Ease of Use: An intuitive interface that is easy to learn and use.

- Affordable Pricing: Pricing that is suitable for angel investors with limited resources.

Implementing a CRM System: Best Practices

Implementing a CRM system requires careful planning and execution. Here are some best practices:

- Define Your Goals: Clearly define your goals for using a CRM. What do you want to achieve? How will you measure success?

- Choose the Right CRM: Select a CRM system that meets your specific needs and budget. Consider the key features listed above.

- Data Migration: Carefully migrate your existing data into the CRM system. Ensure that the data is clean and accurate.

- Training: Provide adequate training to all users on how to use the CRM system effectively.

- Customization: Customize the CRM to meet your specific needs and workflows.

- Integration: Integrate the CRM with other tools, such as email and calendar.

- Regular Maintenance: Regularly maintain the CRM system to ensure that it is running smoothly and that the data is accurate.

- Monitor Performance: Monitor the performance of the CRM system and make adjustments as needed.

Popular CRM Options for Angel Investors

Several CRM systems cater specifically to the needs of angel investors and venture capitalists. Some popular options include:

- Affinity: A relationship intelligence platform that automatically captures and analyzes interactions to identify potential opportunities.

- DealCloud: A CRM and deal management platform designed for investment firms.

- Salesforce: A widely used CRM platform that can be customized to meet the needs of angel investors.

- HubSpot CRM: A free CRM platform that offers a range of features for managing contacts, deals, and marketing.

- Pipedrive: A sales-focused CRM that helps manage leads and track deals.

Conclusion

In the increasingly competitive landscape of angel investing, a CRM system is a vital tool for cultivating relationships, streamlining processes, and maximizing returns. By centralizing contact information, managing deal flow, enhancing portfolio management, and improving communication, a CRM empowers angel investors to make data-driven decisions and build a thriving portfolio of successful startups. Investing in a CRM is an investment in the future of your angel investing career. It’s about building lasting relationships and turning promising startups into profitable ventures.