CRM: The Secret Weapon for Pitch Deck Follow-Up Success

In the high-stakes world of fundraising, the pitch deck is your most potent weapon. But a beautifully crafted deck alone isn’t enough to secure investment. The follow-up – the strategic, personalized communication that happens after you’ve presented your pitch – is where deals are truly won or lost.

Enter the Customer Relationship Management (CRM) system. Far from just a sales tool, a CRM can be your secret weapon for transforming lukewarm interest into committed funding. This article dives deep into how to leverage a CRM to master your pitch deck follow-up, maximize your chances of securing funding, and build lasting investor relationships.

The Follow-Up Fumble: Why It Matters More Than You Think

Imagine this: you’ve poured your heart and soul into creating a compelling pitch deck. You’ve delivered it with passion and precision to a room full of potential investors. You leave feeling optimistic, only to watch your leads go cold. Why?

The most common culprit: a weak or nonexistent follow-up strategy. Here’s why it’s so crucial:

- Demonstrates Professionalism and Organization: A timely, well-structured follow-up shows investors that you’re serious, organized, and value their time.

- Reinforces Your Message: A follow-up allows you to reiterate key points, address any lingering questions, and further solidify your value proposition.

- Builds Relationships: Fundraising isn’t just about securing capital; it’s about building relationships with individuals who will be invested in your company’s success.

- Keeps You Top of Mind: Investors are constantly bombarded with pitches. A strategic follow-up ensures that your company remains fresh in their minds.

- Identifies True Interest: Not every investor will be a perfect fit. A strong follow-up process helps you gauge genuine interest and prioritize your efforts accordingly.

Why Spreadsheets Don’t Cut It (Anymore)

Many startups begin their fundraising journey with spreadsheets to track investor interactions. While spreadsheets are a good starting point, they quickly become unwieldy and inefficient as your network expands. Here’s why a CRM is a far superior solution:

- Centralized Data: A CRM provides a single, unified view of all your investor interactions, contact information, communication history, and notes. No more digging through multiple spreadsheets or email threads.

- Automation: Automate repetitive tasks like sending follow-up emails, scheduling meetings, and updating contact information. This frees up your time to focus on building relationships and closing deals.

- Personalization: Segment your investor list based on their interests, investment history, or other criteria. This allows you to tailor your follow-up messages and deliver a more personalized experience.

- Tracking and Analytics: Monitor the effectiveness of your follow-up efforts with detailed reports and analytics. Identify which messages are resonating, which investors are most engaged, and where you need to adjust your strategy.

- Collaboration: Enable your entire team to access and update investor information in real-time. This ensures that everyone is on the same page and that no opportunities are missed.

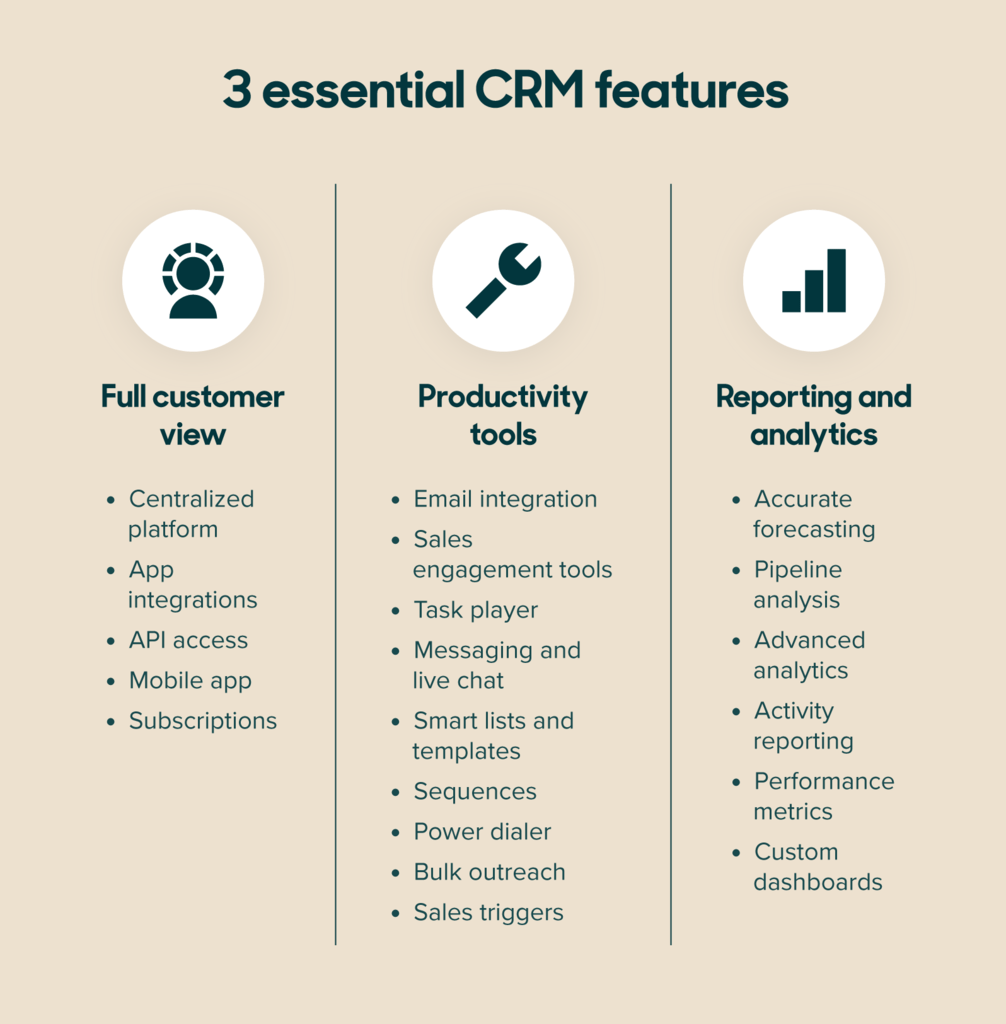

CRM Features for Pitch Deck Follow-Up Mastery

Here are the key CRM features that will transform your pitch deck follow-up process:

- Contact Management: Store detailed information about each investor, including their name, title, company, contact information, investment interests, and communication history.

- Email Integration: Connect your CRM to your email account to track all email correspondence with investors. Send personalized emails directly from the CRM and automatically log all sent and received messages.

- Meeting Scheduling: Use the CRM to schedule meetings with investors and automatically send calendar invites.

- Task Management: Create tasks to remind yourself to follow up with investors, send thank-you notes, or prepare for upcoming meetings.

- Workflow Automation: Automate repetitive tasks like sending follow-up emails or updating contact information based on specific triggers.

- Sales Pipeline Management: Track the progress of each investor through your fundraising pipeline, from initial contact to final investment.

- Reporting and Analytics: Generate reports to track key metrics like investor engagement, conversion rates, and fundraising progress.

- Custom Fields: Add custom fields to your CRM to track specific information about investors that is relevant to your business. For example, you might want to track their investment size preference, industry focus, or stage of investment.

Crafting the Perfect CRM-Powered Follow-Up Strategy

Here’s a step-by-step guide to creating a winning follow-up strategy using your CRM:

- Segmentation is Key: Divide your investor list into segments based on their level of interest, investment focus, and stage of investment.

- Personalize Your Messages: Craft personalized follow-up emails that address each investor’s specific interests and concerns. Avoid generic, one-size-fits-all messages.

- Timing is Everything: Send your initial follow-up email within 24-48 hours of your pitch. This shows that you’re prompt and eager to engage.

- Provide Value: Don’t just reiterate your pitch deck. Offer additional information, insights, or resources that are relevant to the investor’s interests.

- Ask for Specifics: End your follow-up emails with a clear call to action. Ask the investor for a specific commitment, such as a follow-up meeting or a request for more information.

- Track Your Progress: Use your CRM to track the progress of each investor through your fundraising pipeline. Monitor key metrics like email open rates, click-through rates, and meeting attendance.

- Be Persistent, But Not Annoying: Follow up with investors multiple times, but avoid being overly aggressive or pushy. Strike a balance between persistence and respect.

- Document Everything: Keep detailed notes of all your interactions with investors in your CRM. This will help you stay organized and track your progress.

- Analyze and Optimize: Regularly review your follow-up strategy and identify areas for improvement. Experiment with different messages, timing, and calls to action to see what works best.

- Automate When Possible: Set up automated workflows in your CRM to streamline your follow-up process. This will save you time and ensure that no opportunities are missed.

Choosing the Right CRM

There are numerous CRM solutions available, each with its own strengths and weaknesses. Here are a few popular options to consider:

- HubSpot CRM: A free and user-friendly CRM that is ideal for startups.

- Salesforce Sales Cloud: A powerful and customizable CRM that is suitable for larger companies.

- Zoho CRM: A versatile and affordable CRM that is a good option for small businesses.

- Pipedrive: A sales-focused CRM that is designed to help you close deals faster.

When choosing a CRM, consider your budget, your team’s technical expertise, and your specific needs.

Final Thoughts: CRM – Your Fundraising Ally

In the competitive world of startup funding, a CRM isn’t just a tool; it’s a strategic advantage. By leveraging its features to personalize your follow-up, automate your processes, and track your progress, you can significantly increase your chances of securing funding and building lasting relationships with investors. Invest in a CRM, invest in your follow-up, and invest in your company’s future.