CRM: The Unsung Hero of Financial Literacy Programs

In an era defined by complex financial landscapes and a growing need for informed decision-making, financial literacy programs are more vital than ever. These initiatives empower individuals with the knowledge and skills to manage their money wisely, build wealth, and achieve financial security. However, the success of these programs hinges not only on the quality of their content but also on their ability to effectively reach, engage, and track their participants. This is where Customer Relationship Management (CRM) systems step in as a game-changing tool.

Traditionally associated with sales and marketing, CRM has found a powerful new application in the realm of financial literacy. It provides a centralized platform for managing interactions with program participants, streamlining operations, and maximizing impact. By leveraging CRM, financial literacy programs can enhance their reach, personalize their services, and ultimately drive better financial outcomes for their communities.

What is CRM and How Does It Work?

At its core, CRM is a technology that helps organizations manage and analyze their interactions with customers and prospects. It acts as a central repository for customer data, including contact information, communication history, program enrollment details, and financial goals. CRM systems also offer a range of features for automating tasks, tracking progress, and generating reports.

In the context of financial literacy, CRM can be used to:

- Manage Participant Data: Store and organize information about program participants, including their demographics, financial goals, and program preferences.

- Track Interactions: Record all interactions with participants, such as phone calls, emails, workshop attendance, and counseling sessions.

- Automate Communications: Send automated reminders, follow-up emails, and personalized messages to participants based on their program status and engagement level.

- Segment Participants: Group participants based on shared characteristics, such as age, income, or financial goals, to tailor program content and communication strategies.

- Measure Program Effectiveness: Track key metrics, such as program completion rates, participant satisfaction, and financial outcomes, to assess the impact of the program.

- Improve Outreach: Enhance recruitment efforts and target the right audiences.

Benefits of CRM for Financial Literacy Programs

Implementing CRM can bring a multitude of benefits to financial literacy programs, including:

- Improved Participant Engagement: CRM enables programs to personalize their communication and tailor their services to meet the unique needs of each participant. This leads to increased engagement and a higher likelihood of program completion.

- Enhanced Data Management: CRM provides a centralized and organized system for managing participant data, eliminating the need for spreadsheets and manual tracking. This saves time, reduces errors, and improves data security.

- Streamlined Operations: CRM automates many of the administrative tasks associated with running a financial literacy program, such as sending reminders, scheduling appointments, and tracking attendance. This frees up staff time to focus on more strategic activities.

- Increased Program Efficiency: By streamlining operations and improving data management, CRM helps programs operate more efficiently and effectively. This allows them to serve more participants with the same resources.

- Better Reporting and Analytics: CRM provides robust reporting and analytics capabilities, allowing programs to track key metrics and measure their impact. This data can be used to improve program design, tailor communication strategies, and demonstrate the value of the program to funders and stakeholders.

- Enhanced Collaboration: CRM facilitates collaboration among program staff by providing a shared platform for accessing and updating participant information. This ensures that everyone is on the same page and working towards the same goals.

- Improved Outreach: A CRM can improve marketing and advertising efforts and reduce waste on ineffective campaigns.

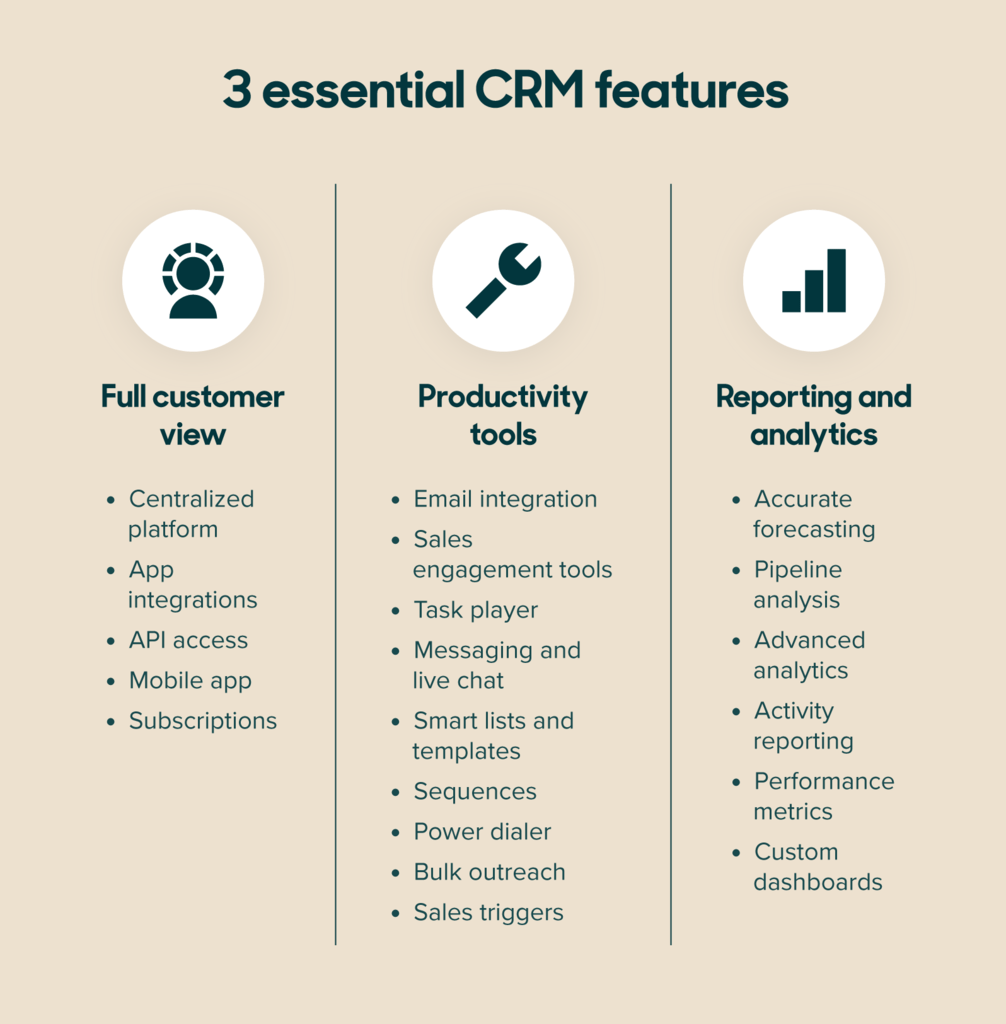

Key Features of CRM for Financial Literacy Programs

When selecting a CRM system for a financial literacy program, it’s important to consider the following key features:

- Contact Management: The ability to store and organize detailed information about program participants, including contact information, demographics, financial goals, and program preferences.

- Communication Tracking: The ability to track all interactions with participants, such as phone calls, emails, and workshop attendance.

- Automation: The ability to automate tasks, such as sending reminders, scheduling appointments, and tracking attendance.

- Segmentation: The ability to segment participants based on shared characteristics, such as age, income, or financial goals.

- Reporting and Analytics: The ability to track key metrics and generate reports on program performance.

- Integration: The ability to integrate with other systems, such as email marketing platforms, online learning platforms, and accounting software.

- Security: Robust security features to protect participant data.

- User-Friendliness: An intuitive and easy-to-use interface that requires minimal training.

- Mobile Access: The ability to access the CRM system from mobile devices, allowing staff to stay connected and manage participant data on the go.

- Customization: The ability to customize the CRM system to meet the specific needs of the financial literacy program.

Implementing CRM: A Step-by-Step Guide

Implementing CRM can be a complex process, but by following these steps, financial literacy programs can ensure a smooth and successful transition:

- Define Goals and Objectives: Clearly define the goals and objectives of the CRM implementation. What do you hope to achieve by using CRM? What key metrics will you track to measure success?

- Assess Needs and Requirements: Conduct a thorough assessment of your program’s needs and requirements. What features and functionality are essential? What integrations are necessary?

- Select a CRM System: Research and compare different CRM systems to find one that meets your needs and budget. Consider factors such as features, functionality, ease of use, security, and integration capabilities.

- Develop a Data Migration Plan: Develop a plan for migrating existing participant data into the new CRM system. This may involve cleaning and formatting data to ensure accuracy and consistency.

- Customize the CRM System: Customize the CRM system to meet the specific needs of your program. This may involve creating custom fields, workflows, and reports.

- Train Staff: Provide comprehensive training to staff on how to use the CRM system. This should include hands-on training and ongoing support.

- Test and Refine: Thoroughly test the CRM system to ensure that it is working properly. Refine the system based on user feedback and program needs.

- Monitor and Evaluate: Continuously monitor and evaluate the performance of the CRM system. Track key metrics and make adjustments as needed to maximize its impact.

Challenges and Considerations

While CRM offers numerous benefits, there are also some challenges and considerations to keep in mind:

- Cost: CRM systems can be expensive, especially for small non-profit organizations.

- Complexity: Implementing and managing a CRM system can be complex and time-consuming.

- Data Security: Protecting participant data is paramount. Programs must ensure that their CRM system has robust security features and that staff are trained on data security best practices.

- User Adoption: Getting staff to adopt and use the CRM system can be a challenge. It’s important to provide comprehensive training and ongoing support to encourage user adoption.

- Integration: Integrating CRM with other systems can be complex and may require technical expertise.

Conclusion

CRM is a powerful tool that can transform the way financial literacy programs operate. By providing a centralized platform for managing participant data, automating tasks, and tracking progress, CRM helps programs enhance their reach, personalize their services, and ultimately drive better financial outcomes for their communities. While there are challenges associated with implementing CRM, the benefits far outweigh the costs. By carefully planning and executing their CRM implementation, financial literacy programs can unlock the full potential of this technology and make a lasting impact on the financial well-being of their participants.