CRM and Predictive Churn Scoring: The Power Duo for Customer Retention

Introduction

In today’s competitive business landscape, acquiring new customers is only half the battle. Retaining existing customers is equally, if not more, crucial for sustainable growth and profitability. A high customer churn rate can severely impact revenue, damage brand reputation, and increase acquisition costs. This is where the combined power of Customer Relationship Management (CRM) systems and predictive churn scoring comes into play.

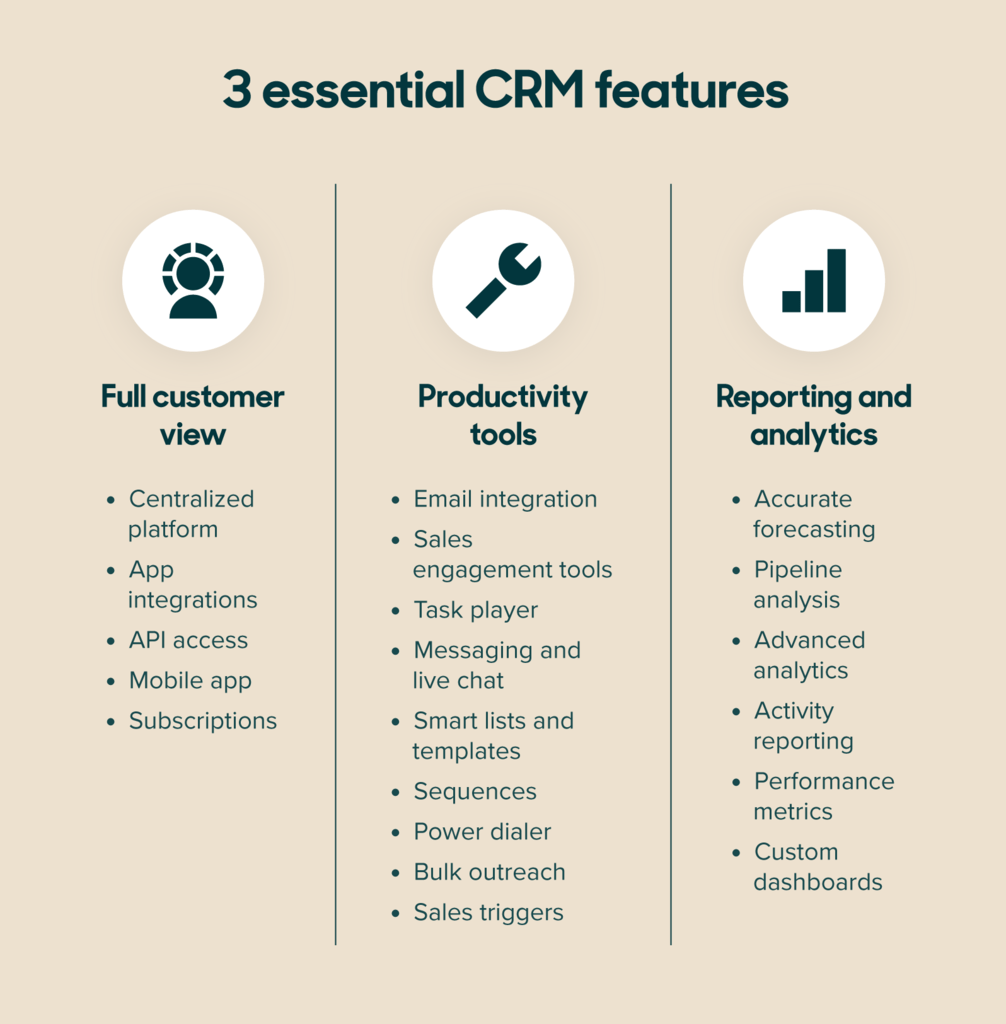

CRM systems have long been the cornerstone of customer-centric businesses, providing a centralized platform for managing customer interactions, data, and relationships. However, CRM alone cannot proactively identify customers at risk of leaving. That’s where predictive churn scoring steps in.

Predictive churn scoring leverages data analytics and machine learning to identify customers who are likely to churn in the near future. By integrating predictive churn scoring into your CRM system, you can transform your CRM from a reactive tool into a proactive engine for customer retention.

Understanding the Basics: CRM and Churn

Before diving into the specifics of predictive churn scoring, let’s revisit the fundamentals of CRM and churn:

- CRM (Customer Relationship Management): CRM systems are designed to manage and analyze customer interactions and data throughout the customer lifecycle. They provide a 360-degree view of each customer, enabling businesses to personalize interactions, improve customer service, and drive sales.

- Churn: Churn, also known as customer attrition, refers to the rate at which customers stop doing business with a company. Churn is a natural part of any business, but high churn rates can be detrimental to long-term success.

Why is Churn Prediction Important?

Predicting customer churn is essential for several reasons:

- Reduced Revenue Loss: By identifying at-risk customers, businesses can proactively intervene to prevent them from leaving, thereby reducing revenue loss.

- Improved Customer Retention: Predictive churn scoring allows businesses to focus their retention efforts on the customers who are most likely to churn, maximizing the impact of these efforts.

- Cost Savings: Retaining existing customers is typically more cost-effective than acquiring new ones. By reducing churn, businesses can save on marketing and sales expenses.

- Enhanced Customer Loyalty: Proactive intervention can demonstrate to customers that you value their business, leading to increased loyalty and advocacy.

- Competitive Advantage: Businesses with lower churn rates tend to have a competitive advantage, as they can focus on growth and innovation rather than constantly replacing lost customers.

Predictive Churn Scoring: How It Works

Predictive churn scoring uses data analytics and machine learning to identify patterns and signals that indicate a customer is likely to churn. The process typically involves the following steps:

- Data Collection: The first step is to gather relevant data from various sources, including your CRM system, transaction records, customer service logs, website analytics, and social media data.

- Data Preprocessing: The collected data is then cleaned, transformed, and prepared for analysis. This may involve handling missing values, removing outliers, and converting data into a suitable format.

- Feature Engineering: Feature engineering involves creating new variables or features from the existing data that may be predictive of churn. Examples include the number of support tickets, the frequency of purchases, or the time since the last interaction.

- Model Building: A machine learning model is trained on the historical data to learn the patterns and relationships that are predictive of churn. Common algorithms used for churn prediction include logistic regression, decision trees, random forests, and support vector machines.

- Model Evaluation: The trained model is evaluated on a holdout dataset to assess its accuracy and performance. Metrics such as precision, recall, F1-score, and AUC are used to evaluate the model.

- Churn Scoring: Once the model is validated, it can be used to assign a churn score to each customer. The churn score represents the probability that a customer will churn within a specified time period.

- Integration with CRM: The churn scores are integrated into the CRM system, allowing sales and customer service teams to identify at-risk customers and take appropriate action.

Benefits of Integrating Predictive Churn Scoring with CRM

Integrating predictive churn scoring with your CRM system offers numerous benefits:

- Proactive Customer Retention: By identifying at-risk customers early on, you can proactively intervene to prevent them from leaving.

- Targeted Retention Efforts: You can focus your retention efforts on the customers who are most likely to churn, maximizing the impact of these efforts.

- Personalized Interventions: You can tailor your interventions to the specific needs and concerns of each at-risk customer.

- Improved Customer Service: By understanding the reasons why customers are likely to churn, you can improve your customer service and address their pain points.

- Increased Customer Loyalty: Proactive intervention can demonstrate to customers that you value their business, leading to increased loyalty and advocacy.

- Data-Driven Decision Making: Predictive churn scoring provides you with data-driven insights into customer behavior, allowing you to make more informed decisions about your retention strategies.

Strategies for Reducing Churn Based on Predictive Scores

Once you have integrated predictive churn scoring into your CRM system, you can implement various strategies to reduce churn:

- Personalized Offers and Incentives: Offer at-risk customers personalized discounts, promotions, or incentives to encourage them to stay.

- Proactive Customer Service: Reach out to at-risk customers to address their concerns and provide assistance.

- Feedback Collection: Collect feedback from at-risk customers to understand their pain points and identify areas for improvement.

- Targeted Communication: Send at-risk customers targeted emails or newsletters with valuable information and resources.

- Relationship Building: Assign dedicated account managers to at-risk customers to build stronger relationships.

- Service Improvements: Use churn insights to identify areas where you can improve your products or services.

Real-World Examples

- Subscription Services: A subscription-based streaming service uses predictive churn scoring to identify subscribers who are likely to cancel their subscriptions. They then offer these subscribers a free month of premium content or a discount on their next renewal.

- Telecommunications: A telecommunications company uses predictive churn scoring to identify customers who are likely to switch to a competitor. They then offer these customers a better deal on their existing plan or a free upgrade to a higher-tier plan.

- E-commerce: An e-commerce company uses predictive churn scoring to identify customers who are likely to abandon their shopping carts. They then send these customers a reminder email with a discount code to encourage them to complete their purchase.

Challenges and Considerations

While predictive churn scoring offers significant benefits, it’s important to be aware of the challenges and considerations involved:

- Data Quality: The accuracy of your churn predictions depends on the quality of your data. Ensure that your data is clean, accurate, and complete.

- Model Selection: Choosing the right machine learning algorithm is crucial for accurate churn prediction. Experiment with different algorithms to find the one that performs best for your data.

- Interpretability: Understand the factors that are driving churn in your business. This will help you develop more effective retention strategies.

- Ethical Considerations: Be mindful of the ethical implications of using predictive churn scoring. Avoid using data that could discriminate against certain groups of customers.

- Dynamic Nature of Churn: Customer behavior and churn patterns can change over time. Regularly retrain your churn prediction model to ensure that it remains accurate.

Conclusion

CRM and predictive churn scoring are a powerful combination for customer retention. By integrating predictive churn scoring into your CRM system, you can proactively identify at-risk customers, personalize your retention efforts, and reduce churn. This will lead to increased revenue, improved customer loyalty, and a competitive advantage in the marketplace. Embracing this data-driven approach to customer retention is no longer a luxury but a necessity for businesses seeking long-term success.