Proactive Retention: Leveraging CRM with Churn Risk Alerts to Minimize Customer Attrition

Introduction

In today’s competitive business landscape, customer retention is paramount. Acquiring new customers is significantly more expensive than retaining existing ones. Therefore, businesses are increasingly focused on strategies that proactively identify and mitigate customer churn – the loss of customers. A powerful tool in this fight against churn is a Customer Relationship Management (CRM) system integrated with churn risk alerts. This combination allows businesses to not only manage customer interactions effectively but also to predict and prevent customer attrition before it happens. This article will explore the benefits, implementation, and best practices of using CRM with churn risk alerts to minimize customer attrition and maximize customer lifetime value.

The High Cost of Customer Churn

Understanding the impact of customer churn is crucial for prioritizing retention efforts. The negative consequences extend far beyond simply losing a single customer’s revenue. Churn leads to:

- Revenue Loss: The most obvious impact. Losing a customer directly reduces your revenue stream.

- Increased Acquisition Costs: Replacing lost customers requires investing in marketing, sales, and onboarding, which can be significantly more expensive than retaining an existing customer. Studies show acquiring a new customer can cost five to twenty-five times more than retaining an existing one.

- Damage to Reputation: Dissatisfied customers are likely to share their negative experiences with others, potentially damaging your brand reputation and deterring new customers. Online reviews and social media amplify these negative impacts.

- Decreased Employee Morale: High churn rates can demoralize employees, especially those in customer-facing roles. They may feel their efforts are ineffective, leading to burnout and decreased productivity.

- Lost Referrals: Happy, loyal customers are a significant source of referrals. Churn eliminates this valuable source of organic growth.

The Power of CRM for Customer Retention

A CRM system is a central repository for all customer-related information, including contact details, interactions, purchase history, support tickets, and more. This centralized view enables businesses to:

- Understand Customer Behavior: CRM provides insights into customer preferences, buying patterns, and engagement levels.

- Personalize Interactions: With a comprehensive understanding of each customer, businesses can tailor their communication and offers to meet individual needs and preferences.

- Improve Customer Service: CRM allows customer service representatives to access a complete history of customer interactions, enabling them to provide faster, more efficient, and more personalized support.

- Streamline Sales and Marketing Efforts: CRM helps sales and marketing teams target the right customers with the right messages at the right time, improving campaign effectiveness and increasing sales conversions.

- Track Customer Satisfaction: CRM can be used to collect feedback from customers through surveys and other methods, allowing businesses to identify areas for improvement and address customer concerns proactively.

Churn Risk Alerts: Predicting Customer Attrition

Churn risk alerts are a proactive feature that identifies customers who are likely to churn based on various indicators and predictive models. These alerts enable businesses to intervene and prevent churn before it occurs. The underlying mechanism usually involves:

- Data Collection and Integration: Gathering data from various sources, including CRM, marketing automation platforms, support systems, and other relevant systems.

- Feature Engineering: Identifying relevant features or indicators that are strongly correlated with churn. These features might include:

- Decreased Engagement: Reduced website visits, email opens, or product usage.

- Negative Feedback: Poor survey scores, negative reviews, or complaints to customer support.

- Decreased Purchase Frequency: A decline in the frequency or value of purchases.

- Unresolved Support Tickets: Open support tickets that have been unresolved for an extended period.

- Change in Contact: Key contact person leaving the company.

- Industry News: Customer’s industry facing downturns.

- Predictive Modeling: Using machine learning algorithms to build a model that predicts the probability of churn based on the identified features. Common algorithms include logistic regression, decision trees, random forests, and support vector machines.

- Alerting and Notification: Generating alerts when a customer’s churn risk score exceeds a predefined threshold. These alerts are typically delivered to customer service representatives or account managers, who can then take appropriate action.

Integrating Churn Risk Alerts with CRM: A Synergistic Approach

The real power lies in integrating churn risk alerts directly into your CRM system. This integration creates a seamless workflow that allows businesses to:

- Identify At-Risk Customers in Real-Time: Customer service representatives can immediately see which customers are at risk of churning when they access their CRM profiles.

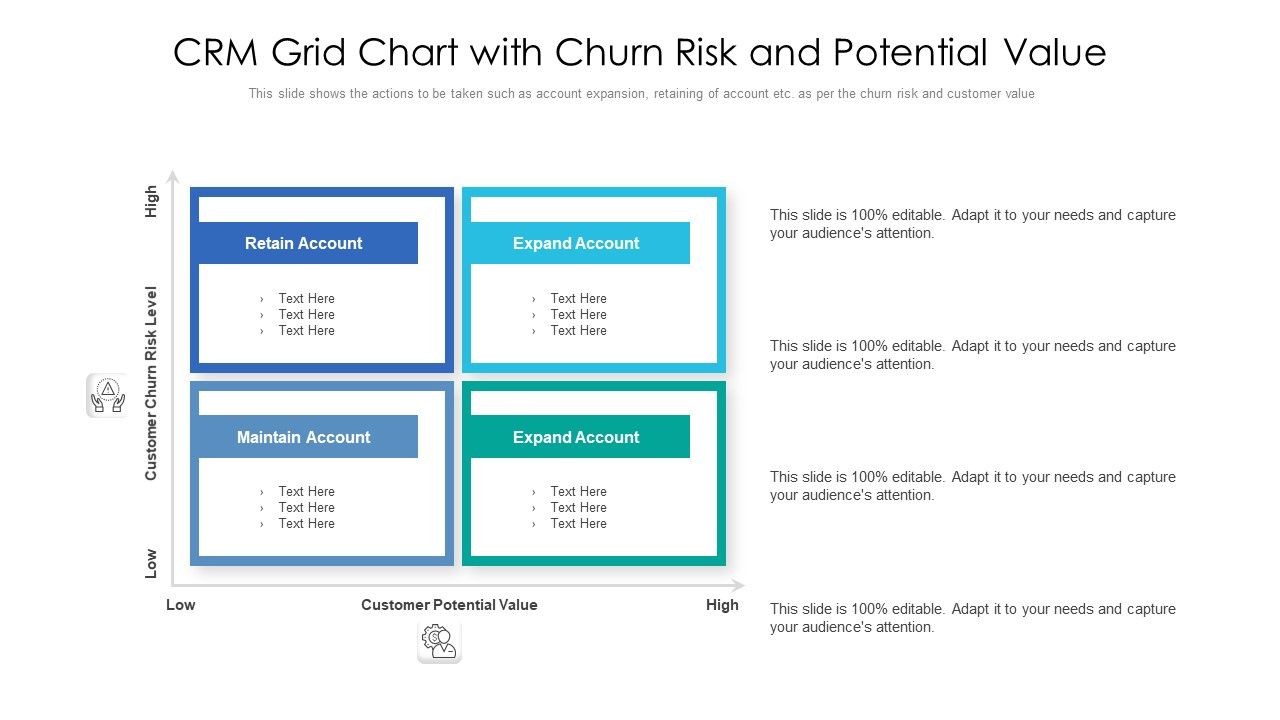

- Prioritize Outreach Efforts: Focus resources on customers with the highest churn risk, ensuring that intervention efforts are targeted and efficient.

- Personalize Intervention Strategies: Use the customer data in the CRM to tailor intervention strategies to individual needs and preferences. For example, offer a discount, provide additional support, or address specific concerns.

- Track the Effectiveness of Intervention Efforts: Monitor the impact of intervention strategies on customer retention rates. This data can be used to refine your approach and improve the effectiveness of your churn prevention program.

- Automate Workflows: Trigger automated email sequences, tasks, or notifications based on churn risk scores. This can help streamline the churn prevention process and ensure that no at-risk customer is overlooked.

Implementing CRM with Churn Risk Alerts: A Step-by-Step Guide

Implementing a CRM with churn risk alerts requires careful planning and execution. Here’s a step-by-step guide:

- Define Your Churn Definition: Clearly define what constitutes churn in your business. Is it a cancellation of a subscription, a failure to renew a contract, or a period of inactivity?

- Identify Key Churn Indicators: Determine which factors are most likely to predict churn in your specific business. Analyze historical data and consult with customer-facing teams to identify relevant indicators.

- Choose a CRM System: Select a CRM system that offers the functionality you need, including the ability to integrate with churn prediction tools and generate alerts. Popular options include Salesforce, HubSpot, Zoho CRM, and Microsoft Dynamics 365.

- Collect and Integrate Data: Gather data from all relevant sources and integrate it into your CRM system. This may involve connecting your CRM to your marketing automation platform, support system, and other business applications.

- Develop a Churn Prediction Model: Work with data scientists or consultants to develop a predictive model that accurately identifies customers at risk of churning.

- Configure Churn Risk Alerts: Set up alerts in your CRM system that are triggered when a customer’s churn risk score exceeds a predefined threshold.

- Train Your Team: Train your customer service representatives and account managers on how to use the CRM system and respond to churn risk alerts.

- Develop Intervention Strategies: Create a playbook of intervention strategies that can be used to address the specific needs of at-risk customers.

- Monitor and Evaluate: Continuously monitor the effectiveness of your churn prevention program and make adjustments as needed. Track key metrics such as churn rate, customer lifetime value, and the success rate of intervention efforts.

Best Practices for Maximizing the Value of CRM with Churn Risk Alerts

To maximize the value of your CRM with churn risk alerts, consider these best practices:

- Focus on Proactive Prevention: Don’t wait until a customer is already on the verge of churning. Identify and address potential issues early on.

- Personalize Your Approach: Tailor your intervention strategies to the individual needs and preferences of each customer.

- Empower Your Team: Give your customer service representatives and account managers the authority and resources they need to resolve customer issues effectively.

- Close the Loop: Track the outcome of intervention efforts and use this information to improve your churn prevention program.

- Continuously Improve Your Model: Regularly update and refine your churn prediction model to ensure that it remains accurate and effective.

- Seek Customer Feedback: Regularly solicit feedback from customers to identify areas for improvement and address any concerns they may have.

- Integrate with Customer Success: Align your churn prevention efforts with your customer success strategy to ensure that customers are getting the most value from your products and services.

- Automate where Possible: Automate tasks like sending personalized emails or creating follow-up tasks for at-risk customers to improve efficiency.

Conclusion

CRM with churn risk alerts is a powerful combination that can help businesses proactively reduce customer attrition, increase customer lifetime value, and improve overall profitability. By leveraging the data and insights available in your CRM system, you can identify at-risk customers, personalize your intervention strategies, and prevent churn before it happens. By implementing the strategies outlined in this article and focusing on continuous improvement, businesses can build stronger customer relationships and achieve sustainable growth. The key is to be proactive, data-driven, and customer-centric in your approach to churn prevention. Embracing this approach will ultimately lead to a more loyal and profitable customer base.