Leveraging CRM and Churn Prediction: A Proactive Approach to Customer Retention

In today’s hyper-competitive business landscape, acquiring new customers is significantly more expensive than retaining existing ones. Therefore, businesses are increasingly focused on customer retention strategies. Customer Relationship Management (CRM) systems have become indispensable tools for managing customer interactions and data. However, simply storing data isn’t enough. Integrating churn prediction into CRM systems allows businesses to proactively identify and address potential customer attrition, leading to improved customer loyalty and increased profitability.

The Power of CRM: A Foundation for Customer Understanding

A CRM system serves as a centralized repository for all customer-related information. This includes:

- Contact Information: Names, addresses, phone numbers, email addresses, and social media profiles.

- Interaction History: Records of all communications with the customer, including emails, phone calls, chat logs, and social media interactions.

- Purchase History: Details of all products or services purchased by the customer, including dates, amounts, and payment methods.

- Service Requests: Records of any support tickets or service requests submitted by the customer, along with their resolution status.

- Demographic Data: Information about the customer’s age, gender, location, and occupation (where available and ethically sourced).

- Customer Segmentation: Categorizing customers based on shared characteristics, such as demographics, purchase behavior, or engagement levels.

By consolidating this information, a CRM system provides a 360-degree view of each customer, enabling businesses to understand their needs, preferences, and behaviors. This understanding is crucial for building strong customer relationships and providing personalized experiences.

The Challenge of Customer Churn: A Costly Reality

Customer churn, also known as customer attrition, refers to the rate at which customers stop doing business with a company. High churn rates can have a devastating impact on a business’s bottom line. The consequences of churn include:

- Lost Revenue: The most obvious consequence is the loss of revenue from customers who no longer purchase products or services.

- Increased Acquisition Costs: Replacing lost customers requires significant investment in marketing and sales efforts to acquire new customers. As mentioned earlier, acquisition costs are much higher than retention costs.

- Damage to Reputation: Customers who churn often leave negative reviews or spread negative word-of-mouth, damaging the company’s reputation.

- Decreased Employee Morale: High churn rates can demoralize employees, especially those in sales and customer service roles, as they see their efforts go to waste.

Therefore, proactively addressing customer churn is essential for long-term business success.

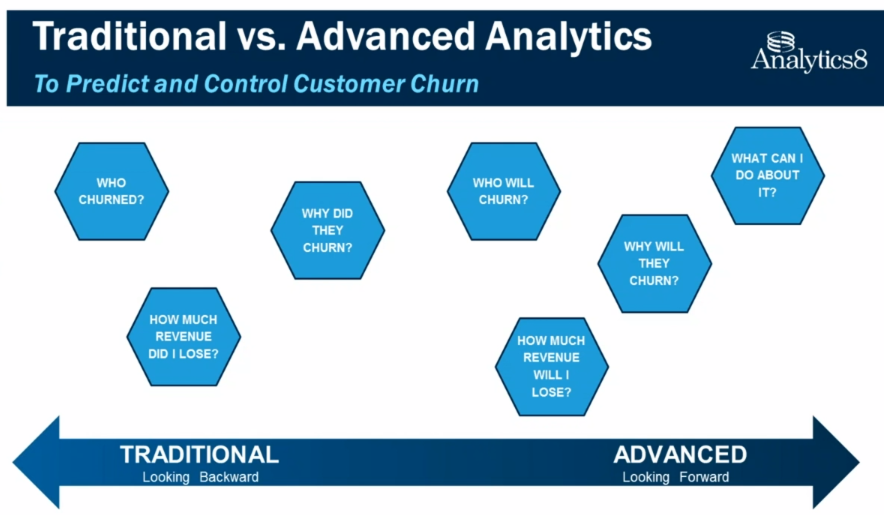

Churn Prediction: Identifying Customers at Risk

Churn prediction involves using data analysis techniques to identify customers who are likely to churn in the future. This is typically accomplished using machine learning algorithms that analyze historical customer data to identify patterns and predictors of churn.

Key Indicators of Potential Churn:

Several factors can indicate that a customer is at risk of churning. These include:

- Decreased Engagement: A decline in website visits, app usage, or social media interactions.

- Reduced Purchase Frequency: A decrease in the number of purchases made by the customer over a specific period.

- Lower Spending: A reduction in the average amount spent per purchase.

- Negative Feedback: Complaints, negative reviews, or low satisfaction scores.

- Increased Service Requests: A sudden increase in the number of support tickets or service requests, particularly those related to dissatisfaction or technical issues.

- Delayed Payments: Late or missed payments can be a sign of financial distress or dissatisfaction with the product or service.

- Changes in Demographics or Behavior: Significant changes in a customer’s demographic information or behavior patterns. For example, a customer moving to a new location or changing jobs.

- Lack of Recent Activity: No interaction with the company for a prolonged period.

Integrating Churn Prediction into CRM: A Proactive Approach

The real power comes from integrating churn prediction models directly into the CRM system. This allows businesses to:

- Automate Churn Risk Assessment: The CRM system can automatically calculate a churn risk score for each customer based on the data and the churn prediction model.

- Identify High-Risk Customers: The system can identify customers with high churn risk scores, allowing businesses to focus their retention efforts on these individuals.

- Trigger Automated Actions: The system can automatically trigger actions based on churn risk scores, such as sending personalized emails, offering discounts, or assigning a dedicated account manager.

- Personalized Interventions: Based on the reasons why a customer is likely to churn, businesses can tailor their interventions to address the specific concerns of each customer. For example, if a customer is churning due to price concerns, they can be offered a discount or a more affordable alternative. If a customer is churning due to poor service, they can be offered a dedicated account manager or prioritized support.

- Monitor the Effectiveness of Retention Efforts: The CRM system can track the effectiveness of retention efforts by monitoring the churn rates of customers who have received interventions. This allows businesses to refine their retention strategies over time.

Benefits of Integrating CRM and Churn Prediction:

The integration of CRM and churn prediction offers numerous benefits:

- Reduced Churn Rates: By proactively identifying and addressing potential churn, businesses can significantly reduce their churn rates.

- Increased Customer Loyalty: Personalized interventions and proactive support can increase customer loyalty and satisfaction.

- Improved Customer Lifetime Value: Retaining customers for longer periods increases their lifetime value to the business.

- Increased Revenue: Reduced churn rates and increased customer lifetime value translate into increased revenue.

- Improved Marketing ROI: By focusing marketing efforts on retaining existing customers, businesses can improve their marketing ROI.

- Better Resource Allocation: By focusing retention efforts on high-risk customers, businesses can allocate their resources more effectively.

- Data-Driven Decision Making: Churn prediction provides valuable insights into customer behavior, allowing businesses to make more data-driven decisions.

Implementing a CRM with Churn Prediction: Key Considerations

Implementing a CRM with churn prediction requires careful planning and execution. Here are some key considerations:

- Data Quality: The accuracy of churn prediction models depends on the quality of the data used to train them. Businesses need to ensure that their CRM data is accurate, complete, and up-to-date. Data cleansing and validation processes are crucial.

- Model Selection: Choosing the right churn prediction model is essential. Different models have different strengths and weaknesses, and the best model will depend on the specific data and business context. Experimentation with different algorithms is often necessary.

- Feature Engineering: Feature engineering involves selecting and transforming the data features used to train the churn prediction model. This is a critical step in the process, as the choice of features can have a significant impact on the model’s accuracy.

- Model Evaluation: It’s crucial to evaluate the performance of the churn prediction model on a regular basis. This involves measuring the model’s accuracy, precision, and recall.

- Integration with CRM: The churn prediction model needs to be seamlessly integrated with the CRM system. This requires careful planning and coordination between the data science and IT teams.

- Actionable Insights: The output of the churn prediction model needs to be translated into actionable insights that can be used to improve customer retention. This requires clear communication between the data science team and the business teams.

- Ethical Considerations: It’s important to consider the ethical implications of using churn prediction. Businesses should avoid using discriminatory or unfair practices based on the model’s predictions. Transparency is key.

- Continuous Improvement: Churn prediction is an ongoing process. Businesses need to continuously monitor the performance of their churn prediction models and refine their retention strategies over time.

Conclusion:

Integrating churn prediction into CRM systems is a powerful strategy for businesses seeking to improve customer retention and increase profitability. By leveraging the data stored in CRM systems and applying machine learning techniques, businesses can proactively identify and address potential customer attrition. This proactive approach leads to stronger customer relationships, increased customer loyalty, and ultimately, a more sustainable and successful business. However, successful implementation requires careful planning, attention to data quality, and a commitment to continuous improvement. By focusing on these key areas, businesses can unlock the full potential of CRM and churn prediction to drive customer retention and achieve long-term success.